Khanh Hoa’s Van Ninh cooperative charts a new course for offshore aquaculture

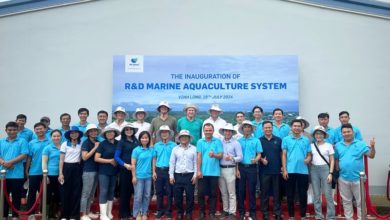

In less than a year, a young cooperative in Khanh Hoa province has become a quiet force for change in Vietnam’s marine farming sector, turning traditional lobster and fish culture into a model for high-tech, sustainable aquaculture.

When the Van Ninh Aquaculture Cooperative was founded on January 23, 2025, it began as a small group of six pioneering farmers. Today, that number has grown to 75 members, most of them raising spiny lobster and marine finfish such as pompano, grouper, and cobia. On average, each member manages around 100 cages, supporting jobs for up to 200 local workers who earn between USD 280 and 400 a month.

From wooden rafts to offshore resilience

The change is most visible at sea. Instead of the old wooden cages scattered along the coast, rows of high-density polyethylene (HDPE) cages now float several nautical miles offshore. “These new systems are safer and cleaner,” says one cooperative member. “They can withstand storms, last longer, and help us produce better-quality fish.”

HDPE cages, both square (5×5 m) and circular (10-15 m diameter), offer durability and environmental advantages that make offshore farming more viable. Five members have already installed 30 square and 10 circular cages as part of the transition.

To test the potential, Van Ninh Cooperative partnered with Syaqua ADN Co., Ltd. in a pilot project raising 20,000 pompano in HDPE cages with commercial feed. After just two months, the fish are thriving. To build expertise, the cooperative invited Dr. Tran Vy Hich from Nha Trang University to conduct hands-on training on marine fish disease management. It has also set up a technical advisory team to provide ongoing support to farmers adopting new systems.

Building markets and momentum

As technology advances, Van Ninh is equally focused on the market. It recently signed an off-take agreement with HMP Co., Ltd. to supply 300 tons of market-size pompano in 2025, worth an estimated VND 36 billion (USD 1.4 million). The cooperative is also teaming up with Thinh Phat Aquaculture Cooperative to develop a grouper nursery model, and working with the Nha Trang Institute of Oceanography to survey new farming sites in Vung Ke, Co Co, and Hon Sam/Vung Ro for a high-tech pompano project.

Financing remains the biggest hurdle. Through coordination with the Vietnam Bank for Social Policies, the cooperative has secured more than VND 2 billion (USD 80,000) in preferential loans for 22 members. Yet for most, it’s still not enough. Access to designated farming waters, and the capital to modernize, are the two bottlenecks holding back large-scale growth.

“The sea is vast, but finding legally recognized farming space isn’t easy,” says a cooperative representative. “Without official leasing or allocation, we can’t get certification for traceability or sell to supermarkets and export buyers.”

A blueprint for the future

To complete the transition to offshore, high-tech production, Van Ninh estimates it will need further investment in workboats, cranes, diving gear, automatic feeders, and oxygen systems. For now, much of the progress relies on cooperation, knowledge-sharing, and local innovation.

Despite the challenges, Van Ninh’s story offers a glimpse of what’s possible when small-scale fishers work together to embrace industrial-scale thinking. With continued policy support and investment, this coastal cooperative could help define the next chapter of Vietnam’s sustainable marine aquaculture, one HDPE cage at a time.

VFM