Pangasius exports to UAE continues to grow

The United Arab Emirates (UAE) is a major consumer of Vietnamese pangasius, with Vietnam being the leading supplier in this market, capturing a 40-50% market share. The export of pangasius to the UAE continues to see significant acceptance and growth, even before the CEPA trade agreement, the first free trade agreement negotiated by Vietnam with a Middle Eastern and African country, is signed.

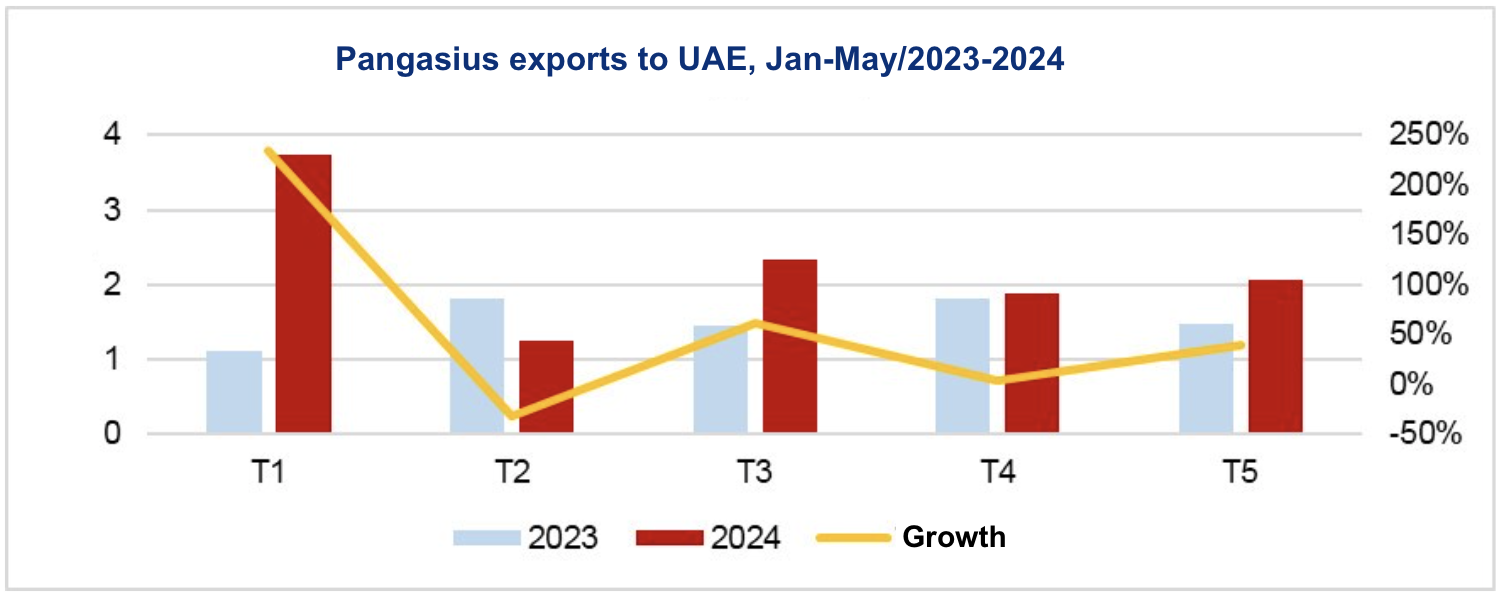

Vietnam’s customs data indicates that in May 2024, the export value of Vietnamese pangasius to the UAE surpassed $2 million, marking a 40% increase compared to May 2023. The total export value of pangasius to this market in the first five months of this year exceeded $11 million, representing a 47% increase compared to the same period last year.

The primary export product in the pangasius sector to the UAE remains frozen pangasius fillets (HS code 03046200). By the end of May 2024, exports of this product to the UAE reached about 6,000 tons, valued at approximately $14 million, reflecting a 22% increase in volume and a 61% increase in value compared to the same period last year, accounting for 90% of the market share. Following closely are frozen pangasius cuts, packaged (HS code 03032400), with an export value of about $1.3 million in the first five months of this year, an 84% increase compared to the same period last year, making up 9% of the market share.

Source: Vasep

Source: Vasep

The UAE has several factors that position it as an essential trade partner for Vietnam: it leads economically among Arab nations and ranks 17th among 61 highly competitive global economies. The average per capita seafood consumption in the UAE is higher than the global average, and the agricultural sector constitutes less than 1% of its economy, resulting in up to 90% of its seafood consumption being imported. The youth in the UAE favor seafood-based proteins amid the country’s growing economy. By the end of 2023, Vietnam and the UAE had nearly completed negotiations on the Vietnam-UAE Comprehensive Economic Partnership Agreement (CEPA), anticipated to be signed in 2024.

The CEPA agreement is expected to facilitate not only direct exports to the UAE but also enable Vietnamese products to penetrate the Middle Eastern market through the “UAE gateway.” The UAE serves as a hub for markets in Africa, Latin America, Europe, and Asia, thanks to its excellent port infrastructure and advanced aviation, allowing for easy market connections.

Nevertheless, the UAE is also a highly competitive market regarding both price and quality, posing significant challenges for Vietnamese businesses. Vietnam must compete directly with several countries that have FTAs with the UAE, such as India, Indonesia, Israel, and Turkey. Businesses from these countries benefit from preferential treatment when exporting to the UAE, giving them a competitive advantage over Vietnamese exporters.

Therefore, to further boost the export of Vietnamese goods to the UAE, Vietnamese businesses need to adopt advanced science and technology in production, revise management methods, and minimize intermediary costs to lower product prices and enhance the competitiveness of Vietnamese products.

VFM