Vietnam’s seafood sector seeks escape from market dependency trap

Vietnam’s seafood sector seeks escape from market dependency trap

The key lies in restructuring market access: diversifying export destinations and product offerings, and enhancing value-added processing to ensure stable, sustainable growth.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood exports surged to USD 3.3 billion in the first four months of 2025, up 21% year-on-year. Shrimp remained the top contributor with a 30% increase, followed by pangasius with 9% growth. China led the charge with a 56% rise in imports, followed by Japan (22%) and the U.S. (7%).

Despite the rebound, U.S. exports are still under pressure from new tariffs and technical trade barriers. Phan Hoang Duy, Deputy CEO of Caseamex, noted that over half of the company’s pangasius exports still go to the U.S., but mounting tariffs are driving up costs and eroding competitiveness. The company is now pivoting toward Europe and Asia, reviving old partnerships and trimming production costs.

Le Hang, Deputy Secretary General of VASEP, urged businesses to actively leverage free trade agreements (FTAs) such as the EVFTA, CPTPP, and RCEP to expand into open, tariff-friendly markets like the EU, Japan, and South Korea. Exploring new markets in the Middle East and Latin America is also crucial to reducing overreliance on a few key buyers. For example, Vietnamese shrimp enjoys zero tariffs in the EU, while Chinese shrimp faces levies of 12–20%.

Although lacking breakthrough performance, seafood exports to the EU have remained stable in 2024, especially for mainstays like whiteleg shrimp, black tiger shrimp, tuna, pangasius, and clams, highlighting strong potential in traditional markets for quality-driven exporters.

At the 31st Global Seafood Expo in Spain (May 2025), VASEP led a delegation of 28 Vietnamese firms to showcase their products and court new buyers—part of a wider effort to diversify markets and reduce exposure to tariff-heavy destinations.

Singapore has emerged as a high-potential partner. Vietnam is now its fourth-largest seafood supplier, overtaking Malaysia and Indonesia, and leads in frozen fish fillets and chilled/frozen products, a category with consistently high demand. Vietnam’s Trade Office in Singapore, working with VASEP, is helping businesses boost packaging quality and meet strict import standards through trade shows and networking.

Brazil is also becoming a strategic market in Latin America. With competitive pricing, steady demand, and recent regulatory improvements, it presents new growth space for pangasius exporters. Around 26 Vietnamese companies now export to Brazil, including major players like Hung Ca, Cadovimex, Nam Viet, and Hoang Long.

A key breakthrough came when Brazil lifted its import suspension on Vietnamese tilapia, expanding product options beyond pangasius, where Vietnam already commands 38% market share. Seafood exports to Brazil rose by over 70% in Q1 2025 alone. Brazil is also reviewing restrictions on additives and phosphates, which previously limited Vietnamese value-added exports like breaded fish and fish balls.

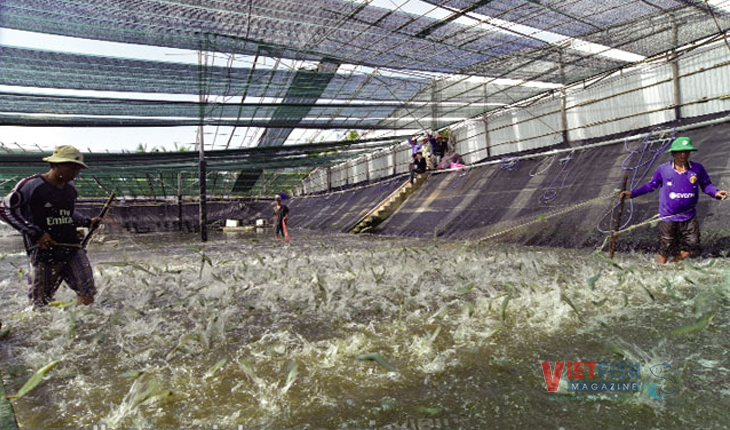

At home, the industry is also intensifying product diversification. Tilapia, now a priority for development, is expected to balance out reliance on shrimp and pangasius. According to Tran Dinh Luan, Director of the Fisheries Department, developing tilapia farming will offer new market buffers and revenue streams.

Vietnamese companies are restructuring their export strategies to focus on high-value processing, value-added products, and alternative markets. FTAs are proving crucial in offsetting risks from high-barrier countries like the U.S.

Deputy Minister of Agriculture and Environment Phung Duc Tien emphasized that market diversification is both a short-term necessity and a long-term strategy in today’s uncertain world. “Firms must meet diverse international standards, including Halal certifications. With proper preparation, we can overcome market barriers,” he said.

He also called on exporters to focus on high-potential markets like China, improve quality control, reduce costs, and enhance processing capacity. “Strengthening the industry’s overall resilience is key to ensuring Vietnam’s seafood sector thrives in an increasingly competitive global environment.”

VFM