The global salmon sector has been experiencing one of the most challenging periods for many years, with production issues in Norway and Chile being particularly acute.

That is one of the key themes of Rabobank’s H2 aquaculture update, which was published this week and outlines how farmers are being plagued by high mortality levels and significant drops in their proportions of superior grade fish due to a combination of factors.

It’s a setback that’s taken industry analysts – who had previously forecast a strong performance for the year – by surprise.

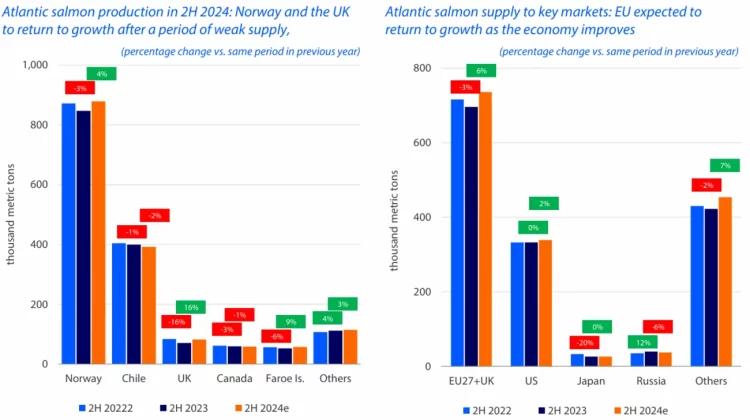

“During 2023 we were expecting Q4 or Q1 2024 to be the first positive quarter for a while, but the low production period has extended and extended. We first had the winter ulcer problem [which caused production levels to drop in Norway] in 2022, but we attributed the drop to the extraordinary performance in 2021 and expected a return to growth in 2023. But there was no growth in 2023,” explains the bank’s senior seafood analyst, Gorjan Nikolik.

“So we said there would be growth in Q1 and Q2 of 2024 and perhaps growth of 7-8 percent for the year, but it hasn’t lived up to expectations. There’s still an inflection point but it’s only happening now and is very mild,” he adds.

Atlantic salmon production (left) and supply to key markets (right) © Edge by Kontali and RaboResearch

As Nikolik explains, the sector is caught in a vicious circle, with the increase in the use of mechanical sea lice treatments in the warmer months damaging the mucosal layers of the salmon, and meaning that they are more susceptible to diseases like winter ulcers when the coastal waters cool.

These issues have led to low average harvest weights in Norway and – perhaps more importantly – a huge surge in downgrades of harvested fish.

“Typically around 90 percent of salmon are superior grade while only around 5 percent are the lowest grade, known simply as production fish, but over the last few quarters there have been weeks when production fish have accounted for up to 35 percent of the harvests,” Nikolik observes.

This has led to spikes in the prices of superior grade salmon – which have reached as high as NOK 130 per kg. However, as Nikolik notes, the average prices that the farmers have achieved have been much lower, due to the high proportion of production grade fish.

Despite this, he adds that the last few months have been more positive.

“There is now a recovery, but from a low point,” Nikolik explains.

“The proportion of production grade salmon is now back to almost normal, supply is coming back and so prices have now corrected to below the levels achieved in 2022 and 2023,” he adds.

Chile, Scotland and Canada

Meanwhile, according to Nikolik, Chilean salmon production has been hit by problems caused by El Nino – such as algal blooms and low oxygen levels – as well as legislative issues – with H1 figures down 11 percent year-on-year.

“There’s uncertainty over the regulations and companies are nervous about exceeding their production allowances,” he notes.

In Scotland, on the other hand, production in H1 rebounded by 13 percent, following two poor years.

“Mortality levels have been much lower and stocking bigger smolts is working,” Nikolik explains.

In Canada, equally, there has been an impressive recovery, with the production levels in some months in the first half of 2024 being up by as much as 33 percent, year-on-year.

This helps to explain why prices in the US have been consistently lower than in 2022 or 2023, despite the reduction of imports from Chile. But Nikolik adds that there’s also been a drop in demand for salmon there, unlike in other key markets such as the EU, China and Brazil.

Looking ahead to H2 of 2024 Nikolik forecasts increases in production in Norway and the UK.

A state-of-the-art high intensity shrimp farm in East Java, Indonesia © MMAF

The shrimp market

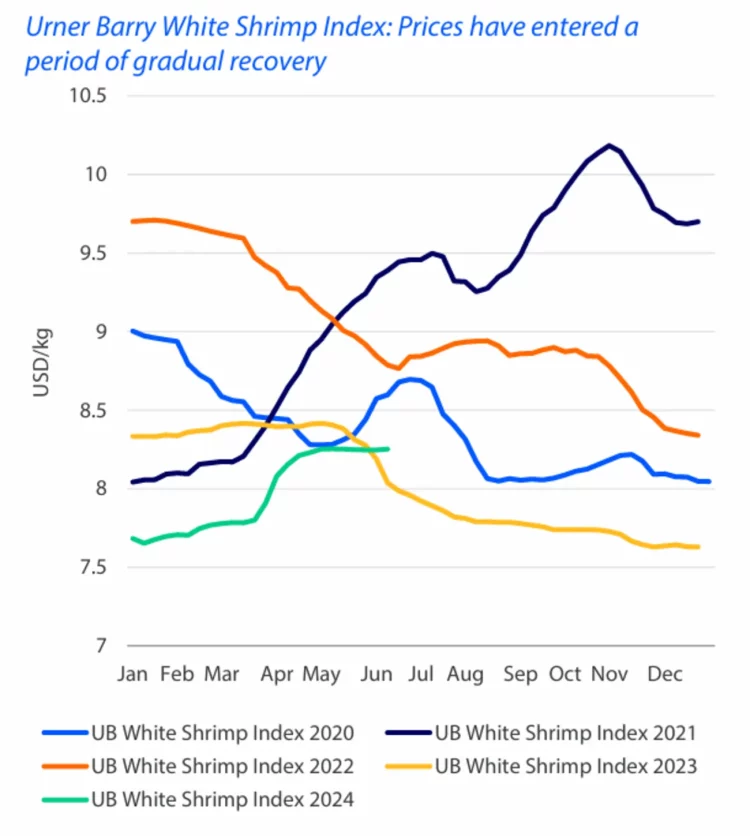

Looking at the shrimp sector, Nikolik notes a partial recovery in prices and demand in the US following a 20-year low in 2023, and expects growth of around 1-3 percent this year, although with the caveat that some of this growth might be short-lived.

“We know that people bought extra volumes to build up their inventories to try to pre-empt the countervailing and anti-dumping duties which are planned in the US,” he explains.

Meanwhile, in Europe, he sees growth in demand too.

“The West is exiting a difficult period when disposable incomes were really impacted. But China – which is a more complex market – is almost a mirror image of the West. My colleagues in China are telling me that demand is picking up, but their domestic producers have increased production, so their import levels might not increase,” he notes.

The Urner Barry white shrimp price index 2020-2024 © Urner Barry

Shrimp production

In terms of production, Nikolik points out that Ecuador turned a corner in April and May – reaching record export figures after a slow start to the year,

“While a few months ago we predicted that Ecuador’s exports would be lower than in 2023, we now expect growth of up to 5 percent, driven mainly by the West,” he observes.

“It’s going to intensify competition in the West, especially as India – which also focuses on exporting to the West – has grown 3.7 percent YTD April. The only producer that’s really declining is Indonesia, which is down 17 percent, so I’m not sure if this price recovery is going to be very long or be that substantial: it remains a buyer’s market,” he adds.

Marine ingredients

Thankfully for beleaguered farmers, there is hope that feed prices could experience a significant drop, thanks to improvements in the supplies of fishmeal and fish oil, as El Nino conditions are replaced by cooler La Nina ones off the Pacific coast of South America.

“We’ve already had one good season in Peru, where 2.47 million tonnes of anchoveta, nearly 100 percent of the quota, was landed. And fish oil yields were very strong, so we expect a rebound in supply and a downward correction in prices, especially if we have another good season – which I think we will. I think the fishmeal price will drop by a few hundred euros per tonne. So we expect a 5-10 percent decline in the feed price by the end of 2024, which will help the shrimp sector in particular,” he notes.

Source: Thefishsite